Ganancias cumple 90 años y los impuestos “temporales” ya explican más del 50% de la recaudación

El proyecto de Ley para gravar la “renta inesperada” del Poder Ejecutivo generó un amplio rechazo entre los empresarios y analistas. Dudas sobre su supuesta transitoriedad

El proyecto de ley para gravar la “renta inesperada” de las empresas producto de la suba de precios tras la guerra en Ucrania volvió a poner sobre la mesa un debate que surge cada vez que se establece un nuevo impuesto: ¿Será transitorio como se busca instalar? ¿O permanecerá en el tiempo como tantos otros gravámenes que se aplicaron en la Argentina en momentos de emergencia económica? “Con los antecedentes que tenemos, cuando se crea un impuesto por única vez, de emergencia, es natural que el contribuyente desconfíe sobre la transitoriedad y suponga que pueda convertirse en permanente”, remarcó a Infobae el tributarista César Litvin.

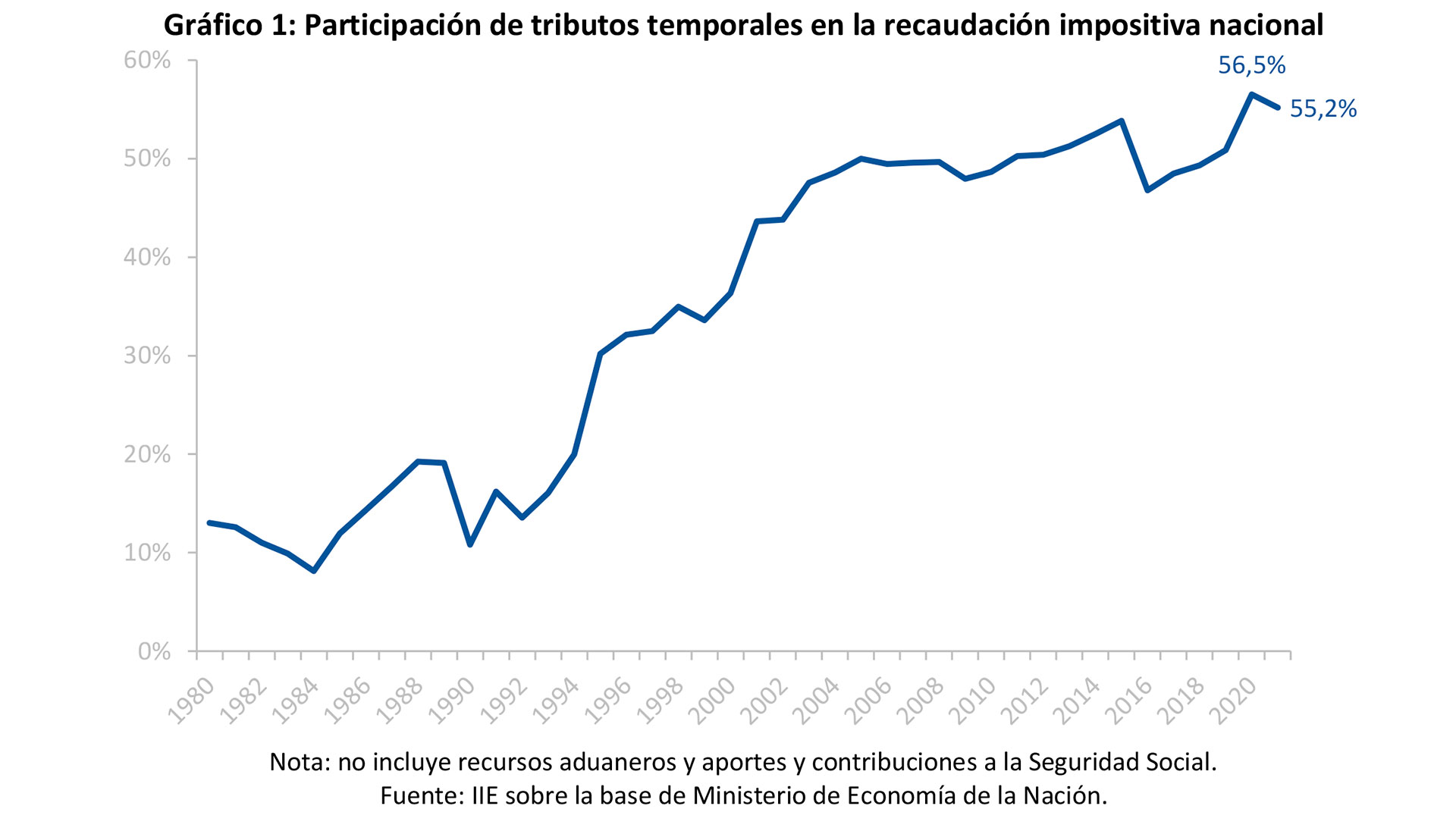

Tanto es así que, si se excluyen los gravámenes aduaneros y los aportes y contribuciones a la Seguridad Social, actualmente los impuestos “temporales” explican más del 50% de la recaudación nacional. Así lo precisó un trabajo del Instituto de Investigaciones Económicas de la Bolsa de Comercio de Córdoba, y ratificaron varios analistas consultados por este medio. Entre estos tributos, se incluye Ganancias; Bienes Personales; el impuesto al cheque, y el PAIS, creado en 2020 y que grava la compra de divisas y los gastos en dólares. “Incluso -precisa el documento- una parte del IVA fue pensada como temporal y, al igual que el resto, todavía se aplica”.

Hace 40 años, los impuestos temporales explicaban el 10% de la recaudación nacional, y con el paso de los años su participación se multiplicó por cinco: hoy más de la mitad de la recaudación nacional se explican por impuestos que surgieron como temporales. El listado es el siguiente:

Hace 40 años, los impuestos temporales explicaban el 10% de la recaudación nacional, y con el paso de los años su participación se multiplicó por cinco

– Impuesto a las Ganancias: nació como un gravamen de emergencia en 1932 bajo el nombre de Impuesto a los Réditos, con una vigencia inicial de tres años. Noventa años después sigue integrando el sistema. ¿Por qué se denomina temporal este tributo que existe en todos los países del mundo? Sucede que los impuestos directos, como Ganancias, sólo pueden cobrarlos las provincias. La Constitución Nacional establece que la Nación puede hacerlo y coparticiparlos en la medida en que sea por un tiempo determinado y en situación de emergencia económica. Su vigencia hasta hoy demuestra que la situación de emergencia se ha ido prorrogando desde el momento de su creación.

“El Impuesto a las Ganancias se va prorrogando porque la Constitución Nacional establece que el Congreso puede establecer impuestos directos en forma transitoria. Es razonable que este impuesto se mantengan porque es un impuesto progresivo que tiene en cuenta la capacidad contributiva de los contribuyentes”, manifestó el tributarista Sebastián Domínguez.

– Impuesto a los débitos y créditos bancarios (cheque): según el informe de la Bolsa de Comercio de Córdoba, este tributo se incorporó a la estructura tributaria en 1983. Había sido restituido luego de haberse aplicado de forma temporal por primera vez en 1976, cuando solo alcanzaba a los débitos en cuenta corriente. Su vigencia se fue extendiendo hasta que dejó de usarse a mediados de los ‘90 y regresó en el 2001 para quedarse.

Para Domínguez, “es un impuesto distorsivo que no tiene en cuenta la capacidad contributiva y afecta la economía”, pero “pensar en su eliminación sería una utopía dado que genera aproximadamente el 10% de la recaudación de impuestos nacionales”. Su propuesta es ir hacia un esquema de cómputo íntegro del impuesto como pago a cuenta de otros tributos, en todos los casos mediante un cronograma anual de implementación gradual.

El Impuesto al Cheque es distorsivo, no tiene en cuenta la capacidad contributiva y afecta la economía (Domínguez)

“Las cargas temporales pasaron de representar 8% de la recaudación impositiva nacional en el regreso de la democracia al 19% a finales de los ‘80. En los ‘90, se sumaron nuevos gravámenes temporales. Bienes Personales surgió en 1991 con carácter de emergencia por nueve períodos fiscales. Se fue prorrogando y sigue. En 1995 se le sumaron tres puntos porcentuales al IVA, cuya alícuota pasó del 18% al 21% por el período de un año, y es la alícuota general hoy. Así, hacia 1999 los gravámenes temporales equivalían a un tercio del global de los ingresos tributarios. Con la vuelta del impuesto al cheque, pasaron a ser la mitad y en 2015 tocaron 54%”, detalla el informe de la Bolsa, que agrega que con la instrumentación del impuesto PAIS y del Aporte Solidario y Extraordinario, equivalieron a 56,5% en 2020 y a 55,2% en 2021.

– Bienes Personales: fue creado en 1991 por nueve años y se fue prorrogando. “El Gobierno anterior prometió su eliminación para promover el ingreso al blanqueo, que termino siendo un éxito. Sin embargo, con posterioridad la Argentina cambió nuevamente las reglas de juego incumpliendo con ese compromiso e incrementando las alícuotas, que pueden llegar hasta el 2,25%”, recordó Domínguez, quien agregó: “En la Argentina, todo lo transitorio se transforma en definitivo y todo lo definitivo en transitorio. Se debería combatir la evasión y racionalizar el gasto público con el objetivo de eliminar el déficit fiscal y modificar el sistema tributario para bajar los impuestos que fomenten las inversiones y la creación de empleo”.

El presidente de Argentina, Alberto Fernández, junto a su ministro de Economía, Martín Guzmán, durante la presentación del proyecto para gravar impositivamente la ´renta inesperada´

El presidente de Argentina, Alberto Fernández, junto a su ministro de Economía, Martín Guzmán, durante la presentación del proyecto para gravar impositivamente la ´renta inesperada´

Eugenio Marí, economista Jefe de la Fundación Libertad y Progreso, dijo a Infobae: “En la Argentina, entre 2004 y la actualidad el gasto público consolidado, sumando la Nación, Provincias y Municipios, subió en 20 puntos del PBI, superando ampliamente el 40%. El punto central es que, para financiar ese gasto, se necesitan recursos, entre los cuales están los impuestos. Dado que el gasto público sigue una tendencia alcista, no es sorprendente entonces que los tributos que llegan ´por una única vez´ al final terminen siendo permanentes. Así ocurrió con Bienes Personales, el Impuesto a los Débitos y Créditos, los Derechos de Exportación, el Impuesto PAIS, la suba de alícuotas del IVA”.

También planteó que resultan transitorias y poco creíbles las bajas o eliminación de impuestos. Por ejemplo, las retenciones, que se eliminaron para casi todos los bienes en 2016, con la administración de Mauricio Macri, y luego regresaron en 2019. Sucedió además con la rebaja de la alícuota de Ganancias a las empresas, que se redujo en 2017 y luego subió nuevamente en 2021. E Ingresos Brutos, que las provincias se habían puesto eliminarlo y finalmente se rompió el llamado consenso fiscal. “Para bajar impuestos de manera creíble y sustentable, lo que hay que modificar es el flujo de gastos que financian los impuestos. De lo contrario, el Estado argentino sigue entrando en compromisos que ya nadie cree”, remarcó Marí.

Entre 2004 y la actualidad el gasto público consolidado, sumando la Nación, Provincias y Municipios, subió en 20 puntos del PBI. El punto central es que, para financiarlo se necesitan recursos (Marí)

César Litvin también recordó que cuando se creó el IVA, en 1974, se derogaron dos impuestos: el de las Ventas, que era nacional, y otro que gravaba las actividades lucrativas, que cobraban las provincias. A los pocos años las jurisdicciones se pusieron de acuerdo y rebautizaron ese impuesto a las actividades lucrativas y lo llamaron Ingresos Brutos. Hoy está vigente ese gravamen y “se superpone con el IVA y con las tasas municipales de seguridad e higiene, que también gravan los ingresos de las empresas. Por eso, cuando se crea un impuesto por única vez, de emergencia, es natural que el contribuyente desconfíe sobre la transitoriedad y suponga que pueda haber un nuevo impuesto que se convierta en permanente”, acotó el tributarista.

Las jurisdicciones rebautizaron el impuesto a las actividades lucrativas y lo llamaron Ingresos Brutos. Hoy se superpone con el IVA y con las tasas municipales de seguridad e higiene (Litvin)

El proyecto de Ley de la “renta inesperada” alcanza a empresas con Ganancia Neta Imponible o Ganancia Contable de más de $1.000 millones y que cumpla con al menos una de estas condiciones: que su margen de ganancia (ganancia contable sobre sus ingresos) sea superior al 10% en 2022; o que haya tenido un aumento del margen de ganancia en 2022 en relación al 2021 de, al menos, 20%. El texto elaborado por el Ministerio de Economía propuso aplicar a esa renta unaalícuota del 15% y aseguran que tendrá vigencia sólo para el ejercicio fiscal 2022.

INFOBAE

Great post. I was checking continuously this blog and I am inspired! Extremely useful info specifically the ultimate section 🙂 I handle such info much. I used to be looking for this certain information for a long time. Thank you and good luck.

Thanks for your personal marvelous posting! I truly enjoyed reading it, you’re a great author.I will make certain to bookmark your blog and will often come back later on. I want to encourage you to continue your great work, have a nice day!

I’ll right away grab your rss as I can’t find your email subscription link or newsletter service. Do you’ve any? Please let me know in order that I could subscribe. Thanks.

Good write-up, I am normal visitor of one’s site, maintain up the excellent operate, and It’s going to be a regular visitor for a long time.

I like this weblog very much, Its a very nice situation to read and find info .

Hey there! I just wanted to ask if you ever have any trouble with hackers? My last blog (wordpress) was hacked and I ended up losing several weeks of hard work due to no data backup. Do you have any solutions to prevent hackers?

After study a couple of of the weblog posts in your website now, and I actually like your approach of blogging. I bookmarked it to my bookmark website list and can be checking back soon. Pls check out my web page as nicely and let me know what you think.

I like this post, enjoyed this one regards for putting up. «What is a thousand years Time is short for one who thinks, endless for one who yearns.» by Alain.

Greetings from California! I’m bored at work so I decided to browse your site on my iphone during lunch break. I really like the info you present here and can’t wait to take a look when I get home. I’m shocked at how quick your blog loaded on my mobile .. I’m not even using WIFI, just 3G .. Anyhow, fantastic site!

I am glad to be a visitor of this unadulterated web site! , thanks for this rare info ! .

I was recommended this blog by my cousin. I am not sure whether this post is written by him as nobody else know such detailed about my difficulty. You are amazing! Thanks!

I know this if off topic but I’m looking into starting my own weblog and was wondering what all is required to get set up? I’m assuming having a blog like yours would cost a pretty penny? I’m not very web savvy so I’m not 100 certain. Any tips or advice would be greatly appreciated. Thanks

whoah this blog is wonderful i love reading your posts. Keep up the good work! You know, many people are searching around for this information, you can aid them greatly.

I’ve been absent for a while, but now I remember why I used to love this site. Thanks , I¦ll try and check back more often. How frequently you update your web site?

I loved as much as you will receive carried out right here. The sketch is attractive, your authored material stylish. nonetheless, you command get bought an nervousness over that you wish be delivering the following. unwell unquestionably come more formerly again as exactly the same nearly a lot often inside case you shield this hike.

I believe this is one of the most significant information for me. And i’m satisfied studying your article. However wanna observation on some common issues, The site style is ideal, the articles is actually great : D. Good activity, cheers

Great beat ! I would like to apprentice even as you amend your site, how could i subscribe for a blog site? The account aided me a appropriate deal. I were a little bit familiar of this your broadcast offered bright transparent concept

Some truly interesting information, well written and broadly speaking user pleasant.

Some truly excellent information, Gladiolus I noticed this. «Three things you can be judged by your voice, your face, and your disposition.» by Ignas Bernstein.

Hi there, I found your website via Google while looking for a related topic, your web site came up, it looks good. I have bookmarked it in my google bookmarks.

The next time I read a blog, I hope that it doesnt disappoint me as much as this one. I mean, I know it was my choice to read, but I actually thought youd have something interesting to say. All I hear is a bunch of whining about something that you could fix if you werent too busy looking for attention.

Thanks for another informative website. The place else may just I get that type of info written in such a perfect means? I’ve a project that I’m simply now running on, and I have been on the glance out for such information.

This design is incredible! You obviously know how to keep a reader amused. Between your wit and your videos, I was almost moved to start my own blog (well, almost…HaHa!) Wonderful job. I really enjoyed what you had to say, and more than that, how you presented it. Too cool!

Some really interesting points you have written.Aided me a lot, just what I was searching for : D.

obviously like your web-site but you have to check the spelling on several of your posts. A number of them are rife with spelling problems and I find it very bothersome to tell the truth nevertheless I will surely come back again.

I conceive this site has got some real wonderful information for everyone : D.

Rattling good info can be found on web blog.

Greetings! I’ve been reading your web site for a long time now and finally got the bravery to go ahead and give you a shout out from New Caney Tx! Just wanted to tell you keep up the excellent job!

Greetings! I’ve been reading your site for a long time now and finally got the courage to go ahead and give you a shout out from New Caney Texas! Just wanted to tell you keep up the fantastic job!

I really enjoy looking through on this internet site, it contains excellent articles. «Words are, of course, the most powerful drug used by mankind.» by Rudyard Kipling.

Hello, Neat post. There’s a problem together with your site in internet explorer, would test thisK IE still is the market chief and a good portion of other folks will leave out your great writing due to this problem.

Some genuinely wonderful information, Sword lily I observed this.

What i don’t understood is in fact how you’re not actually much more smartly-favored than you may be right now. You’re so intelligent. You realize thus considerably when it comes to this topic, made me in my opinion consider it from so many varied angles. Its like women and men are not interested except it’s one thing to do with Girl gaga! Your personal stuffs outstanding. All the time deal with it up!

F*ckin’ remarkable things here. I’m very glad to see your article. Thanks a lot and i’m looking forward to contact you. Will you please drop me a mail?

Would you be involved in exchanging hyperlinks?

Thank you for the sensible critique. Me & my neighbor were just preparing to do a little research on this. We got a grab a book from our local library but I think I learned more from this post. I’m very glad to see such wonderful information being shared freely out there.

This design is spectacular! You certainly know how to keep a reader amused. Between your wit and your videos, I was almost moved to start my own blog (well, almost…HaHa!) Fantastic job. I really loved what you had to say, and more than that, how you presented it. Too cool!

There is noticeably a bundle to know about this. I assume you made certain nice points in features also.

Lovely blog! I am loving it!! Will be back later to read some more. I am bookmarking your feeds also

I precisely desired to say thanks all over again. I’m not certain the things that I could possibly have carried out in the absence of the type of tips and hints shown by you directly on my question. It had become a real depressing scenario in my circumstances, nevertheless looking at a new professional manner you managed the issue took me to leap with contentment. Now i am thankful for your advice as well as sincerely hope you comprehend what a powerful job you are always doing training the rest with the aid of your blog. More than likely you’ve never encountered all of us.

I’m truly enjoying the design and layout of your site. It’s a very easy on the eyes which makes it much more pleasant for me to come here and visit more often. Did you hire out a developer to create your theme? Fantastic work!

Thankyou for helping out, fantastic info .

Some genuinely grand work on behalf of the owner of this web site, perfectly great subject matter.

I am forever thought about this, thanks for posting.

I will immediately snatch your rss feed as I can not to find your e-mail subscription link or e-newsletter service. Do you have any? Kindly allow me realize so that I could subscribe. Thanks.

Thanks for the sensible critique. Me and my neighbor were just preparing to do a little research on this. We got a grab a book from our area library but I think I learned more clear from this post. I’m very glad to see such excellent information being shared freely out there.

Thank you for sharing excellent informations. Your site is so cool. I’m impressed by the details that you have on this blog. It reveals how nicely you understand this subject. Bookmarked this web page, will come back for extra articles. You, my friend, ROCK! I found simply the info I already searched everywhere and just couldn’t come across. What a perfect website.

Sumatra Slim Belly Tonic primarily focuses on burning and eliminating belly fat.

Hi my friend! I want to say that this article is awesome, great written and come with almost all important infos. I?¦d like to peer extra posts like this .

I am only commenting to let you know what a helpful experience my wife’s child found viewing your site. She figured out lots of details, which included how it is like to possess a very effective coaching heart to let other folks without hassle completely grasp specific grueling subject areas. You actually surpassed our own expected results. Many thanks for providing the valuable, healthy, explanatory as well as cool guidance on this topic to Jane.

Java Burn: What is it? Java Burn is marketed as a natural weight loss product that can increase the speed and efficiency of a person’s natural metabolism, thereby supporting their weight loss efforts

I’ve been browsing online greater than 3 hours nowadays, yet I never discovered any fascinating article like yours. It is pretty worth sufficient for me. In my view, if all site owners and bloggers made excellent content as you did, the web shall be a lot more useful than ever before.

What i don’t realize is in reality how you’re no longer really a lot more neatly-appreciated than you may be right now. You’re very intelligent. You recognize therefore significantly in the case of this matter, produced me personally consider it from a lot of various angles. Its like men and women are not fascinated until it is something to accomplish with Woman gaga! Your personal stuffs outstanding. Always maintain it up!

I admire your piece of work, thanks for all the interesting content.

What is Gluco6 Supplement? Gluco6 is a blend of doctor-formulated ingredients promising to help users develop healthy blood sugar ranges.

obviously like your website however you need to check the spelling on quite a few of your posts. A number of them are rife with spelling problems and I to find it very bothersome to inform the reality however I¦ll certainly come again again.

I have read a few good stuff here. Definitely worth bookmarking for revisiting. I wonder how much effort you put to make such a great informative website.

Somebody essentially help to make seriously articles I would state. This is the first time I frequented your website page and thus far? I amazed with the research you made to make this particular publish incredible. Fantastic job!

I like this blog very much so much good information.

I’m truly enjoying the design and layout of your blog. It’s a very easy on the eyes which makes it much more pleasant for me to come here and visit more often. Did you hire out a designer to create your theme? Fantastic work!

obviously like your web site but you need to test the spelling on several of your posts. Several of them are rife with spelling problems and I to find it very bothersome to inform the reality nevertheless I will definitely come again again.

Thank you for sharing excellent informations. Your website is very cool. I am impressed by the details that you’ve on this web site. It reveals how nicely you perceive this subject. Bookmarked this website page, will come back for more articles. You, my friend, ROCK! I found simply the info I already searched everywhere and simply couldn’t come across. What a perfect site.

Someone essentially help to make seriously articles I would state. This is the very first time I frequented your web page and thus far? I amazed with the research you made to make this particular publish extraordinary. Great job!

I know this if off topic but I’m looking into starting my own blog and was curious what all is needed to get setup? I’m assuming having a blog like yours would cost a pretty penny? I’m not very internet smart so I’m not 100 positive. Any suggestions or advice would be greatly appreciated. Appreciate it

I enjoy your piece of work, regards for all the good articles.

You have observed very interesting details ! ps decent site.

There is evidently a bundle to realize about this. I believe you made various nice points in features also.

It’s a shame you don’t have a donate button! I’d definitely donate to this excellent blog! I suppose for now i’ll settle for bookmarking and adding your RSS feed to my Google account. I look forward to new updates and will share this blog with my Facebook group. Talk soon!

Great write-up, I’m regular visitor of one’s web site, maintain up the excellent operate, and It’s going to be a regular visitor for a lengthy time.

What¦s Taking place i’m new to this, I stumbled upon this I’ve discovered It positively useful and it has helped me out loads. I’m hoping to give a contribution & help different customers like its aided me. Good job.

You completed a few good points there. I did a search on the theme and found a good number of folks will consent with your blog.

I am not really wonderful with English but I find this really easygoing to read .